In today’s digital world, having efficient and streamlined financial operations is crucial for small businesses aiming to stay competitive. One tool that’s been gaining popularity among small business owners is Melio Payments. This innovative platform offers a variety of benefits that simplify and enhance financial transactions. Here’s a comprehensive guide on how to use Melio Payments and the key advantages it offers.

Table of Contents

What is Melio Payments?

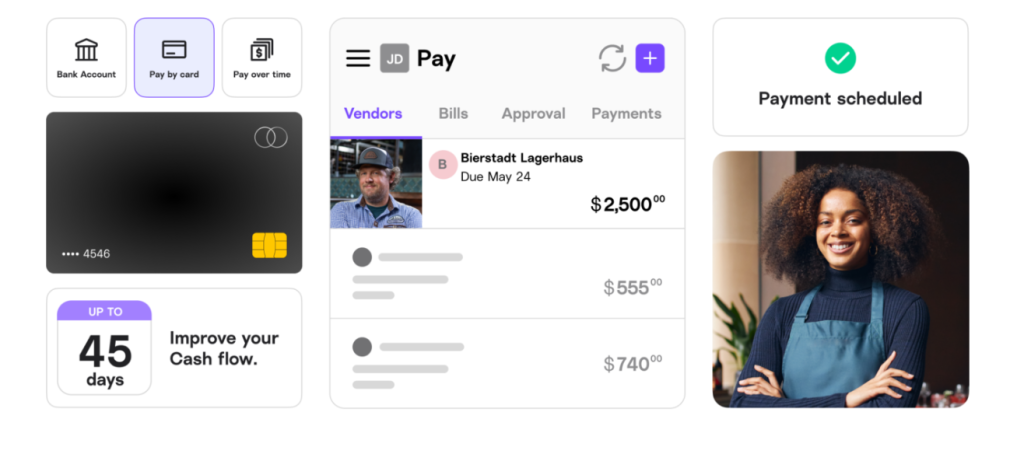

Melio Payments is an online payment solution that makes it easy for businesses to pay vendors, suppliers, and contractors. It supports various payment methods, including bank transfers and credit cards, even if the recipient only accepts checks. This flexibility makes it an ideal choice for small businesses looking to streamline their accounts payable processes.

How to Use Melio Payments

1. Setting Up Your Account

- Sign Up: Start by visiting the Melio Payments website and signing up for a free account. You’ll need to provide basic information about your business and banking details.

- Verification: Complete the verification process by confirming your email and linking your bank account.

2. Adding Vendors

- Vendor Information: Add your vendors’ details, including their names, contact information, and preferred payment methods.

- Payment Preferences: Specify how each vendor prefers to be paid—by bank transfer or check.

3. Scheduling Payments

- Create a Payment: Go to the payment section and input the amount, payment date, and method. You can choose to pay immediately or schedule payments for a future date.

- Upload Bills: Upload your bills or invoices to Melio Payments, which will automatically extract payment details.

4. Executing Payments

- Review and Confirm: Check your payment details to make sure everything is accurate, then confirm the payment. Melio will handle the rest, whether it’s sending a bank transfer or mailing a check to your vendor.

5. Tracking and Management

- Payment Dashboard: Use the Melio dashboard to track your payments, view payment history, and manage your accounts payable.

- Notifications: Set up notifications to receive alerts about upcoming payments, due dates, and payment confirmations.

Benefits of Using Melio Payments for Small Businesses

1. Streamlined Payment Process

Melio Payments simplifies the payment process, allowing small business owners to manage all their payments in one place. This reduces the time spent on administrative tasks, freeing up valuable time for other business activities.

2. Flexible Payment Options

With Melio, businesses can pay vendors using bank transfers or credit cards, even if the vendor only accepts checks. This flexibility helps manage cash flow more effectively and can earn credit card rewards.

—–Read Melio Payments Review 2024 In Details—–

3. Improved Cash Flow Management

Melio’s scheduling feature allows businesses to delay payments until the due date, optimizing cash flow. By strategically scheduling payments, businesses can ensure they have sufficient funds to cover other expenses.

4. No Subscription Fees

Melio Payments does not charge subscription fees, making it a cost-effective solution for small businesses. There are fees for credit card transactions, but the benefits of improved cash flow and credit card rewards can often offset these.

5. Enhanced Security

Melio Payments employs robust security measures, including encryption and secure data storage, to protect sensitive financial information. This ensures that your business transactions are safe and secure.

6. Integration with Accounting Software

Melio integrates seamlessly with popular accounting software like QuickBooks, simplifying bookkeeping and ensuring that your financial records are always up to date.

7. Access to Capital

Melio offers financing options, providing small businesses with access to capital when needed. This can be particularly beneficial during periods of growth or unexpected expenses.

Conclusion of Melio Payments for Small Businesses

Melio Payment is a powerful tool for small businesses looking to streamline their financial operations and improve cash flow management. By offering flexible payment options, enhanced security, and seamless integration with accounting software, Melio helps small business owners save time, reduce administrative burdens, and focus on growing their businesses. Start leveraging Melio Payments today to take your financial operations to the next level.

For more information and to sign up, visit the Melio Payments website.